China’s slowing GDP and the trade dispute with the United States have injected a cloud of uncertainty into the Chinese economy. Some observers have predicted that these developments will spell bad news for Chinese consumption, which has thus far been a powerhouse for economic growth.

Our research shows that they may not need to worry too much.

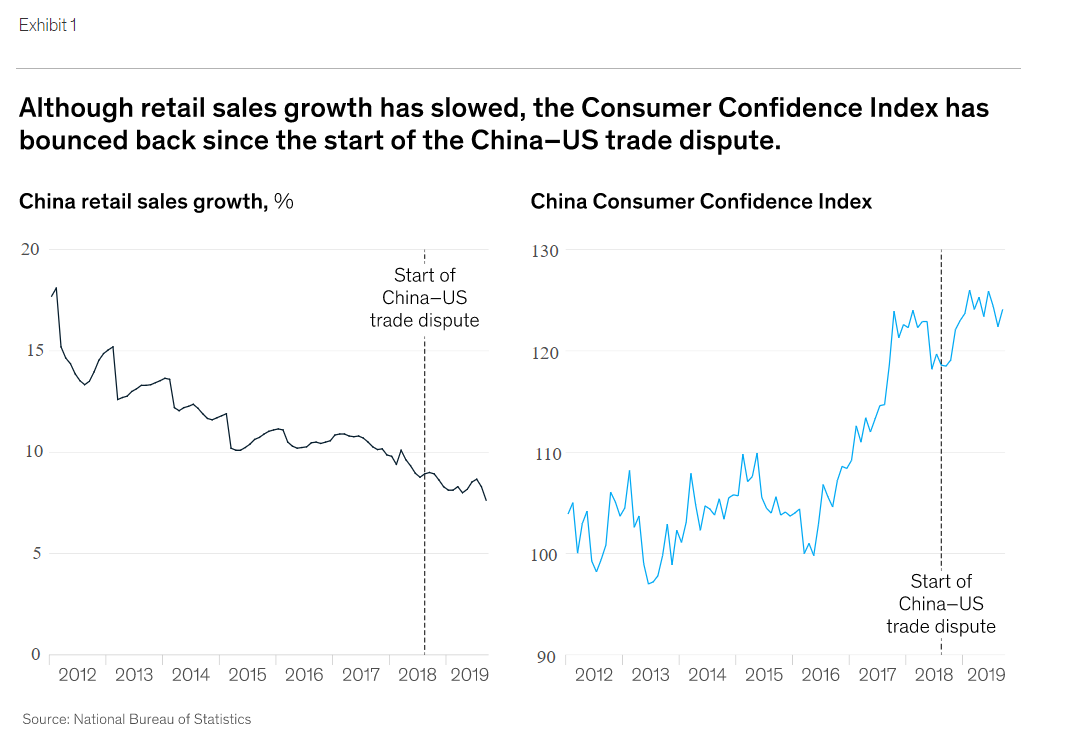

Although traditional drivers of China’s economy—investment, exports, and manufacturing—are struggling, the country’s consumers remain confident. After dipping in the second half of 2018, the Consumer Confidence Index hit a ten-year high earlier this year (Exhibit 1).

Consumers in China are proving to be remarkably resilient and remain a powerful, transformative force not just in China but also across the globe. Although it’s likely the growth rate for consumer spending will be slightly lower in 2019 than in 2018, consumers continue to increase their spending by a considerable margin and are eager to pay for items with a strong value proposition. This year’s Singles Day (also referred to as Double 11), for instance, was record shattering. Total sales on all platforms were up 31 percent over last year and reached 410 billion renminbi ($58 billion), far more than Cyber Monday’s and Black Friday’s online sales combined.

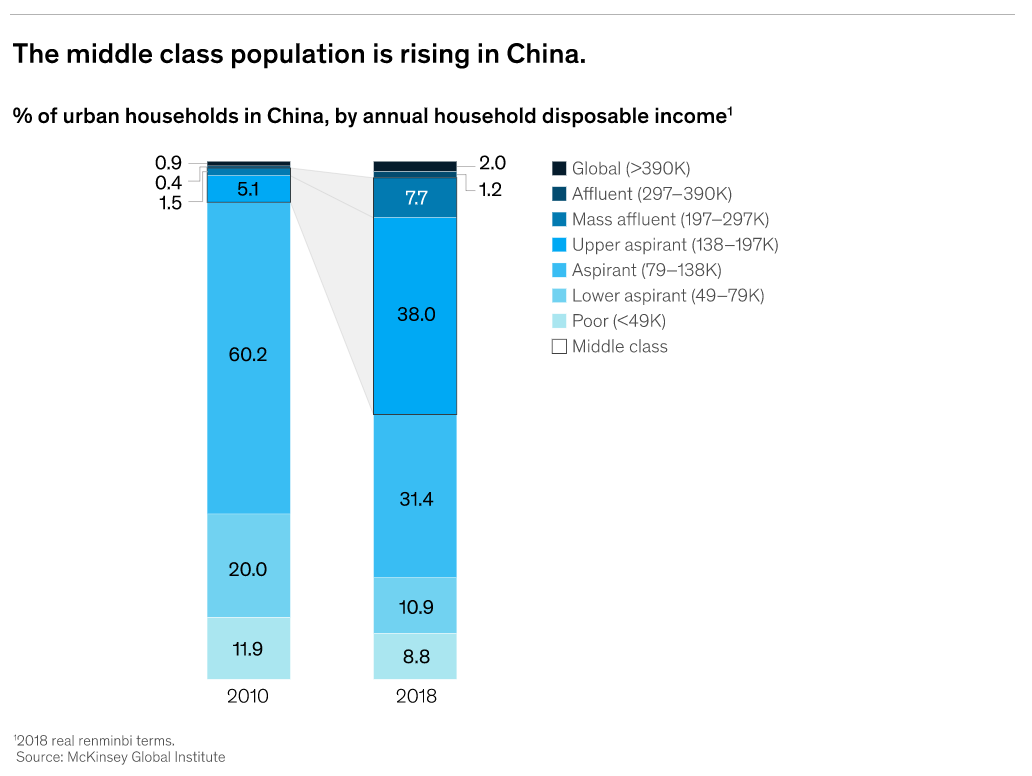

The overall pace at which Chinese consumption has grown is almost hard to imagine: just a decade ago, most urban Chinese had enough money to cover basic needs like food, clothes, and housing (92 percent had annual household disposable incomes of 140,000 renminbi or less). Today, half are living in relatively well-to-do households (annual disposable incomes of 140,000 renminbi to 300,000 renminbi) where they have ample funds for perks like regular meals out, beauty products, flat-screen TVs, and holiday travel (Exhibit 2) .

Most rural Chinese, on the other hand, remain relatively poorer; nearly all the growth has come from cities. These urban consumers are now the main driver of the Chinese economy, with their spending accounting for more than 60 percent of GDP growth.1 And across the globe, Chinese consumer spending represented 31 percent of household consumption growth from 2010 to 2017.

Now, ten years into this expansion, consumer behavior is shifting, and we see a bifurcation among Chinese consumers. On one hand, a segment of consumers in lower-tier cities continues spending money freely without any worry about cost or saving for the future. Other consumers, though, mostly in large, expensive cities such as Beijing, Guangzhou, and Shanghai are responding to the dip in China’s economic growth and the increased cost of urban living by adjusting their attitudes and, in some cases, their spending.

This is the subject of McKinsey’s most recent China Consumer Report, which is part of a series of comprehensive reports the firm has done on urban Chinese consumer behavior since 2005. Between May and July 2019, we surveyed 5,400 respondents from 44 cities, representing approximately 90 percent of China’s GDP and half of its population. We asked them about their spending patterns in 2018 versus the previous year and tracked their attitudes and expectations about products across a variety of categories. We also did deep dives into several different consumer segments to reveal deeper layers of insight. This year, we present five key consumer trends that companies need to know to help them formulate their operational strategies and stay competitive in one of the world’s most important markets (Exhibit 3).

Download full report here.